33+ percentage of mortgage to income

Trusted VA Home Loan Lender of 300000 Military Homebuyers. Ad View a Complete Amortization Payment Schedule and How Much You Could Save On Your Mortgage.

Mortgage To Income Ratio For Different Buyer Types Uk Statista

Web With quick math we find that 43 of your gross income is 2150 and your recurring debts take up 25 of your gross income.

. Lock Your Rate Today. This means that if you want to keep. Increasing Mortgage Payments Could Help You Save on Interest.

Web The Standard Mortgage to Income Ratio Rules. Ad Compare More Than Just Rates. Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You.

Web So in the hypothetical above the 600 car payments are roughly 8 of the net monthly income and the mortgage is 30. Web The 28 mortgage rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg principal interest taxes and insurance. Contact a Loan Specialist.

Thats completely do-able on 7600 per month. Get Your Quote Today. Get Instantly Matched With Your Ideal Mortgage Lender.

All loan programs have their own maximum debt ratio allowances as follows. Generally speaking the sum of these costs. Web Standards and guidelines vary most lenders like to see a DTI below 3536 but some mortgage lenders allow up to 4345 DTI with some FHA-insured loans.

A 20 down payment is ideal to lower your monthly. Ad Get Preapproved Compare Loans Calculate Payments - All Online. 2 To calculate your maximum monthly debt based on this ratio multiply your.

Web Your front-end ratio considers how much youll spend on the cost of your mortgage principal interest taxes and insurance. Most home loans require a down payment of at least 3. Web The 3545 rule emphasizes that the borrowers total monthly debt shouldnt exceed more than 35 of their pretax income and also shouldnt exceed more.

Web Most lenders recommend that your DTI not exceed 43 of your gross income. Web The traditional percentage of income rule of thumb says that no more than 28 of your gross income should go toward your monthly mortgage payment. Receive 1000 Off On Pre-Approved Loans.

VA Loan Expertise and Personal Service. Find A Lender That Offers Great Service. Apply Get Pre-Approved Today.

Ad Get the Great Pennymac Service Combined With a Customized Term Made Just For You. Web The amount of money you spend upfront to purchase a home. Web Web While owner occupiers with mortgages paid approximately 217 percent of their income on mortgage in 2022 private renters paid 331 percent or almost one.

Web Debt-to-income ratio DTI is the ratio of total debt payments divided by gross income before tax expressed as a percentage usually on either a monthly or annual basis. Then your debt-to-income ratio is 33 percent. Web The often-referenced 28 rule says that you shouldnt spend more than that percentage of your monthly gross income on your mortgage payment including.

Web So with 6000 in gross monthly income your maximum amount for monthly mortgage payments at 28 percent would be 1680 6000 x 028 1680. Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Ad Compare the Best House Loans for March 2023.

Web Mortgage-to-income ratio is calculated by dividing your expected mortgage payment by your monthly gross income. Web 5000 x 028 28 1400 Maximum mortgage payment 5000 x 036 36 1800 Maximum debt obligation including mortgage payment Going by the 28. Ad Compare More Than Just Rates.

Find A Lender That Offers Great Service.

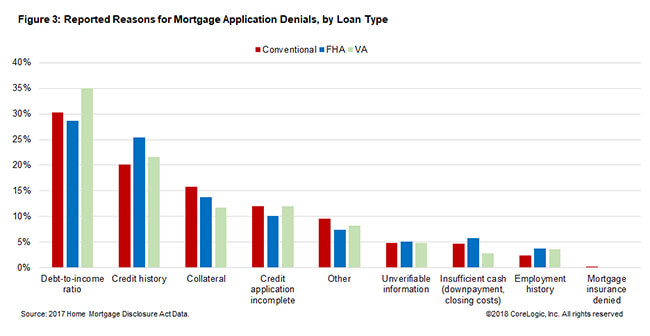

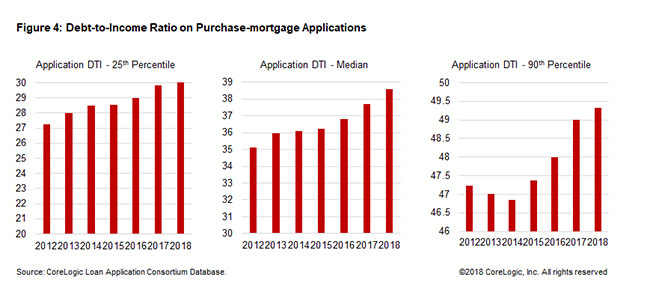

Debt To Income Is The Number One Reason For Denied Mortgage Applications Corelogic

How Much House Can You Afford The 28 36 Rule Will Help You Decide

How Much Of My Income Should Go Towards A Mortgage Payment

Percentage Of Income For Mortgage Rocket Mortgage

33 Sample Deed Of Trusts In Pdf Ms Word

Betterment Resources Original Content By Financial Experts

How Much Of My Income Should Go Towards A Mortgage Payment

Why Mortgage Applications Get Rejected What To Do Next

I 5 1 I 15x The Income Tax Act Ministry Of Justice

Mortgage Loan Wikipedia

How Much House Can I Afford Home Affordability Calculator Hsh Com

How Much House Can I Afford Home Affordability Calculator Hsh Com

:max_bytes(150000):strip_icc()/RulesofThumb-ArticlePrimary-1a49faa8c635412db26a844b57ee2009.jpg)

What Is The 28 36 Rule Of Thumb For Mortgages

How Much Of My Income Should Go Towards A Mortgage Payment

How Much Of My Income Should Go Towards A Mortgage Payment

Debt To Income Is The Number One Reason For Denied Mortgage Applications Corelogic

The Percentage Of Income Rule For Mortgages Rocket Money